Many people approach investing with one goal in mind: fast results. They look for quick price gains, short-term trades, and instant profits. But some of the most reliable wealth-building strategies work in the opposite way. They focus on patience, consistency, and long-term planning. One of the clearest examples of this approach is investing now for dividends later.

Dividend investing is not about excitement. It is about building a future income stream—one payment at a time. This article explains how dividend investing works, why starting early matters, and how long-term investors benefit from patience and discipline.

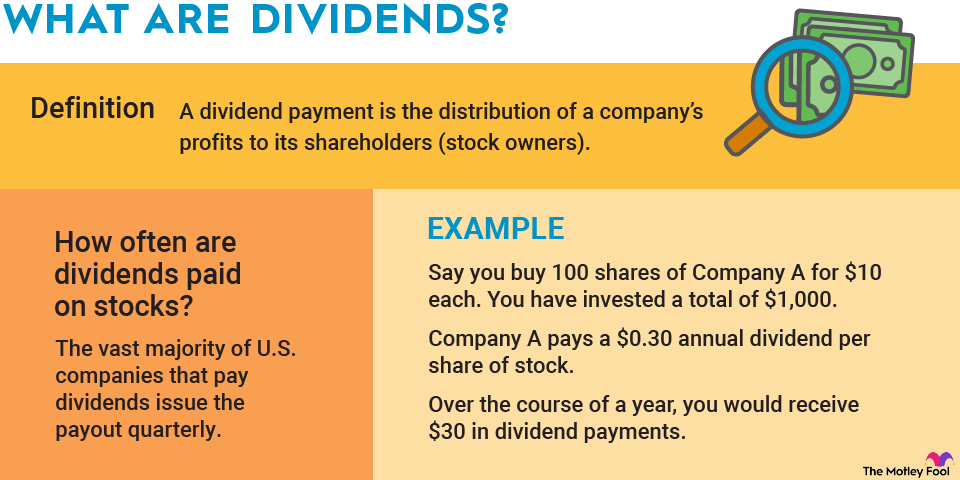

What Are Dividends?

Dividends are payments companies make to shareholders, usually from profits. They are typically paid quarterly, although some companies pay monthly or annually.

Why Companies Pay Dividends

- To reward shareholders

- To signal financial stability

- To attract long-term investors

Dividends represent real cash flow, not paper gains.

Why Investing Early Makes a Difference

Time is one of the most powerful forces in investing.

The Power of Compounding

When dividends are reinvested, they begin to generate dividends of their own. Over time, this compounding effect can significantly increase both income and portfolio value.

Starting early allows:

- More compounding cycles

- Smaller contributions to grow larger

- Less pressure to chase high-risk returns

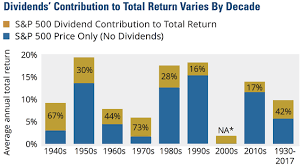

Dividends vs. Capital Gains

Both play a role in investing, but they serve different purposes.

Capital Gains

- Depend on market prices

- Often unpredictable

- Require selling assets to realize profits

Dividends

- Provide ongoing income

- Are paid regardless of daily market swings

- Can be reinvested or used as cash flow

Dividend investing focuses on income reliability rather than price movement.

The Appeal of Dividends in Long-Term Planning

Dividends can support long-term financial goals.

Passive Income Potential

Dividend income can eventually help cover:

- Living expenses

- Retirement costs

- Emergency needs

Over time, dividends may reduce reliance on employment income.

Psychological Benefits

Receiving regular income can help investors stay calm during market volatility, reducing emotional decision-making.

Reinvesting Dividends: A Smart Strategy

Reinvestment accelerates growth.

Dividend Reinvestment Plans (DRIPs)

Many brokers offer automatic dividend reinvestment, allowing investors to purchase additional shares without manual effort.

Benefits include:

- Compounding growth

- Dollar-cost averaging

- Increased future income

Choosing Dividend-Paying Investments

Not all dividends are equal.

Dividend Stocks

Established companies with consistent earnings often provide stable dividends. Look for:

- Strong cash flow

- Reasonable payout ratios

- Long dividend histories

Dividend ETFs and Funds

These offer diversification across multiple dividend-paying companies, reducing individual stock risk.

Avoiding Common Dividend Investing Mistakes

Dividend investing requires discipline.

Chasing High Yields

Extremely high yields may signal financial trouble. Sustainable dividends matter more than headline numbers.

Ignoring Business Quality

Dividends are only as reliable as the company paying them.

Lack of Diversification

Relying on one sector or company increases risk.

Dividends During Market Downturns

Dividends can provide stability during difficult periods.

Income Even When Prices Fall

Even when stock prices decline, many companies continue paying dividends.

Opportunity to Buy More Shares

Reinvested dividends can purchase more shares at lower prices, boosting long-term returns.

Tax Considerations

Dividend income may be taxable depending on location and account type.

Planning Ahead

Tax-advantaged accounts can improve long-term outcomes. Understanding tax rules helps avoid surprises.

Building a Dividend Strategy Over Time

Dividend investing works best with consistency.

Practical Steps

- Invest regularly

- Reinvest dividends early

- Review holdings periodically

- Increase contributions as income grows

Small steps today can create meaningful income later.

Dividends and Retirement Planning

Dividend income often becomes more valuable over time.

Shifting From Growth to Income

Younger investors may focus on growth and reinvestment. As retirement approaches, dividends can shift from reinvestment to income.

Flexibility in Retirement

Dividend income can supplement pensions or savings without selling assets.

Realistic Expectations Matter

Dividend investing is not a shortcut.

What It Offers

- Steady income growth

- Reduced emotional stress

- Long-term financial support

What It Does Not Offer

- Instant wealth

- Guaranteed returns

- Zero risk

Patience remains essential.

Final Thoughts

Investing now for dividends later is about playing the long game. It rewards discipline, consistency, and patience rather than speed and speculation. By starting early, reinvesting dividends, and focusing on quality investments, investors can build a reliable income stream over time.

Dividends may start small, but with time, they can grow into something powerful: financial confidence and freedom built quietly in the background.

Summary:

It isn�t hard to get started. All you need is $100 to $500 to open an account, and anywhere from $25 to $50 monthly to continue building your stock or mutual fund portfolio. In fact, a young person aged 20 could deposit $2,000 and then not another dime. In forty years he or she might have tens of thousands of dollars.

Keywords:

investing,finance

Article Body:

No matter what age you are or even your level of employment or economic position, it may be a good idea to start preparing now, even in a meager way, for eventual financial security. Some people feel they need every dollar they make to get by from one paycheck to the next. While this may be true for some, there are others who squander significant sums on insignificant things. They could be socking that money away into an investment account that, over time, could lead to huge savings and a comfortable retirement.

It isn�t hard to get started. All you need is $100 to $500 to open an account, and anywhere from $25 to $50 monthly to continue building your stock or mutual fund portfolio. In fact, a young person aged 20 could deposit $2,000 and then not another dime. In forty years he or she might have tens of thousands of dollars. The stock market has followed fairly predictable patterns since its inception in the 1800s in New York City. Although historic events like the Great Depression and several global wars have impacted its activity, the gains and losses remain fairly consistent, with most investors earning a predictable return on their investment.

Of course, no one can predict what the future holds, or whether the pattern will continue. And none of us should invest more money than we can afford to lose�just in case the world economy crashes one of these days. But with steady deposits that continue to compound and earn interest over time, a sensible and prudent investor can substantially increase the amount of money going for retirement or a dream vacation at some future point.

If you are thinking about opening an investment account, do a little online browsing for more information. Visit sites like E-trade or Scott�s Trades to see how the process works. Start reading your newspaper�s financial pages for details about the latest stock prices and market trends. Do a little paper trading by following the daily stock news. Instead of actually purchasing stock, however, work it out on a piece of paper by pretending to buy a certain amount of stock for the specified price and then watching to see how it performs over the following week. Chart your gains or losses to figure out whether your stock deal was successful. If you do this for several months, you will soon learn to understand more about the stock market and how to buy and sell like the pros.

Even if your budget is tight, try to set aside a little money to open an investment account from any windfalls that come your way from job bonuses, inheritances, or cash gifts. Some people set aside their annual job raise, or part of it, as part of their investment strategy. Then, as your budget becomes looser with paid-off bills or grown-up kids, you may be able to start having a standard monthly amount deducted automatically from your paycheck and deposited into your investment account. This could take the form of a Roth IRA (individual retirement account), a money market fund, a mutual fund portfolio, or individual stock shares.

It probably is a good idea to take an investment class at the community college or sign up for a financial planning seminar. Success may be just a few years away if you start now and plan right.

Leave a Reply